Investment Platform Reviews

Review our top platforms with 100% reliable data

Stockspot Review

At Stockpot, we are delighted to hear about your positive experience with investing through your Self-Managed Super Fund (SMSF). We are pleased that you have achieved decent returns and found our service exceptionally supportive and helpful. Our team is dedicated to providing outstanding assistance, particularly with the complexities of reporting and documentation for SMSF investments. We understand that navigating these requirements can be challenging, and we strive to offer the support and information you need, even if you’re unsure of exactly what you require. Your feedback highlights our commitment to delivering a seamless and enjoyable experience for our clients. We are honored by your recommendation and appreciate your kind words. Thank you for choosing Stockpot. We look forward to continuing to support your investment journey with the highest level of service and expertise.

About Stockspot

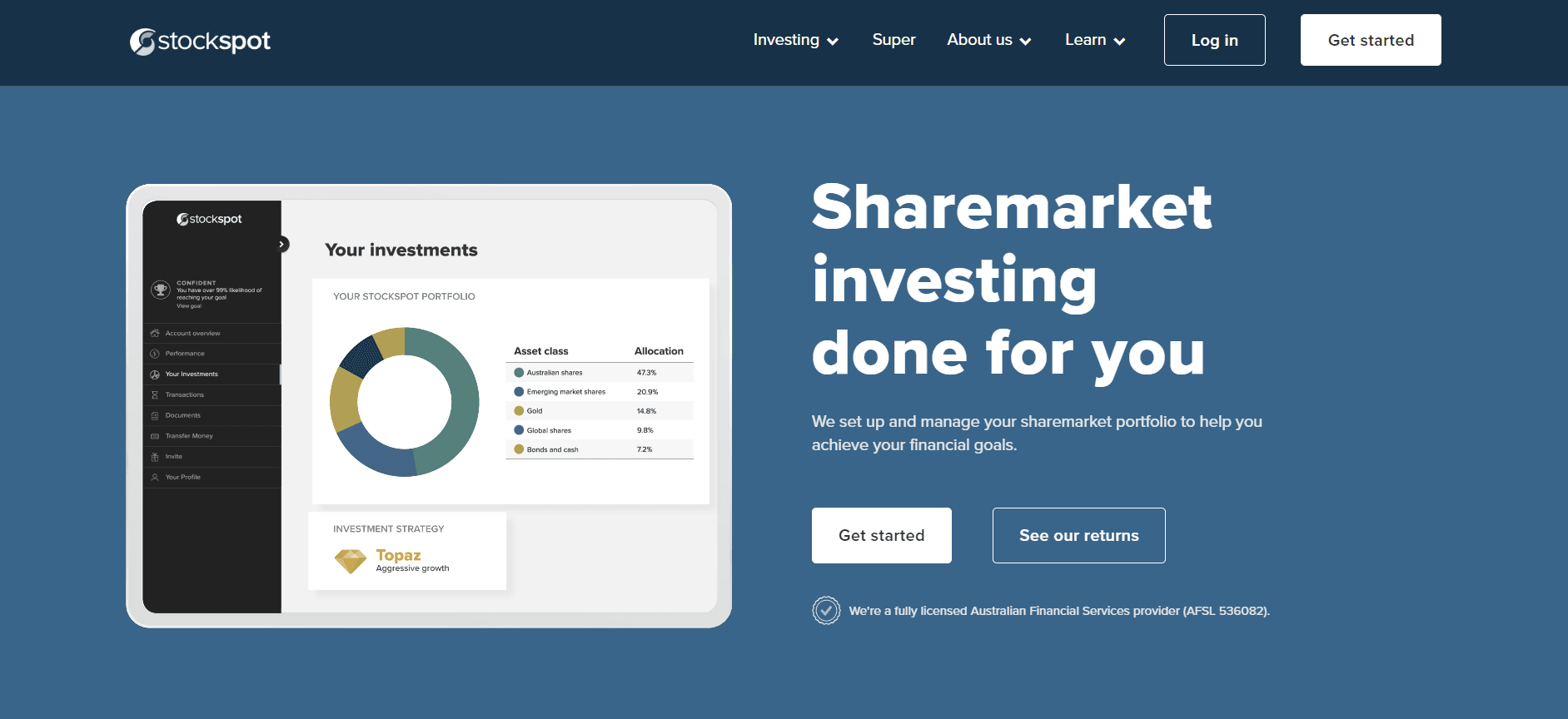

Stockspot is Australia’s first and largest robo-advisor, providing automated investment management through diversified ETF portfolios. Founded in 2013, the platform helps both beginners and experienced investors grow wealth with a simple, low-cost, and transparent approach to investing.

The platform offers a complete ecosystem that includes personalised portfolios based on risk profiles, automatic rebalancing, dividend reinvestment, tax reporting, and access to Stockspot Savings for short-term cash investments. Stockspot stands out for its easy-to-use interface, disciplined long-term strategy, strong security measures, and ASIC regulation, making it a trusted choice for investors who prefer a convenient, “set-and-forget” solution to building wealth.

Key Features

Automated Portfolio Management

Stockspot builds personalised ETF portfolios based on each investor’s goals and risk profile with ongoing automation to handle allocation rebalancing and dividend reinvestment—ideal for hands-off investing.

Diversified ETF Portfolios

The platform invests across Australian and global shares bonds and gold ETFs to provide broad diversification and reduce risk through modern portfolio theory.

Automatic Rebalancing

Stockspot regularly rebalances portfolios to maintain the right asset mix ensuring long-term discipline without requiring manual intervention from investors.

Stockspot Savings

Offers a cash investment option using high-interest Cash ETFs giving clients a secure place to park funds for short-term goals while still earning attractive returns.

Tax Reporting Tools

Investors receive clear automated tax reporting making end-of-year tax management simple and hassle-free.

Security & Regulation

Stockspot is ASIC-licensed with client assets held directly under CHESS HINs ensuring ownership transparency and strong protection.

Human Support When Needed

While fully automated Stockspot also provides access to licensed advisors for guidance blending convenience with expert support.

Pros and Cons

- Pros: Stockspot offers fully automated, diversified ETF portfolios tailored to risk profiles, with features like auto-rebalancing, dividend reinvestment, and tax reporting. It is ASIC-regulated, transparent with CHESS-sponsored holdings, beginner-friendly, and ideal for hands-off, long-term investing.

- Cons: Management fees are higher than a DIY ETF approach, investment options are limited compared to broader broker platforms, withdrawals can feel slower or require extra steps, and the service is focused only on Australian investors with no access to direct stock or crypto trading.

Stockspot Investment Experience

Stockspot provides a simple and transparent platform designed to make investing accessible for all types of investors. Here’s an overview of the investment experience offered by Stockspot.

Personalized Portfolios

Stockspot creates tailored portfolios using Australian and global ETFs spread across shares bonds and gold. Each portfolio is designed using modern portfolio theory to balance risk and return.

Automated Rebalancing

To ensure portfolios stay aligned with client goals Stockspot automatically rebalances investments when markets move maintaining the right asset mix without investor intervention.

Dividend Reinvestment

All dividends from ETF holdings are automatically reinvested helping investors grow their wealth through compounding over the long term.

Stockspot Savings

For those seeking a safe home for short-term funds Stockspot offers Stockspot Savings. This option invests in high-interest Cash ETFs combining security with competitive returns compared to standard savings accounts.

A User-Friendly Trading Experience

Stockspot provides a simple and transparent platform designed to make investing accessible for all types of investors. Here’s an overview of the investment experience offered by Stockspot.

Mobile Apps

Stockspot offers mobile apps for both Android and iOS devices allowing investors to track their portfolios monitor performance and view insights on the go. The app provides a seamless experience with features like automated portfolio updates rebalancing notifications and access to account statements.

Web Platform

Accessible through any modern web browser Stockspot’s web platform offers a clean and intuitive interface. Investors can view their personalised portfolio track returns access tax reports and manage deposits or withdrawals without the need for complex tools or installations.

Copy Trading Platform

Stockspot’s copy trading lets users mirror the strategies of top-performing traders making it beginner-friendly while still attractive to advanced users who want to monetize their strategies.

Deposits and Withdrawals

Funding an account with Stockspot is straightforward through bank transfer or BPAY with no transaction fees. Withdrawals can be requested anytime with proceeds typically credited back to the client’s bank account within a few business days. While fully online Stockspot maintains human support for clients who need help during the process.

Platform Security and Regulation

Stockspot is regulated by ASIC and holds an Australian Financial Services License (AFSL). Unlike many platforms client investments are not pooled—each investor owns their ETFs directly under their own CHESS HIN ensuring full transparency and protection. Advanced encryption two-factor authentication and strict privacy practices further secure the platform.

Range of Offerings

Stockspot is known for its fully automated investing ecosystem. It provides a simple low-cost and disciplined way to build wealth through diversified ETF portfolios.

On On Stockspot you have access to:

- Personalized ETF portfolios based on goals and risk profile.

- Automatic rebalancing and portfolio management.

- Dividend reinvestment for long-term compounding.

- Stockspot Savings with high-interest Cash ETFs.

- Tax reporting tools for easier compliance.

- Access to licensed advisors for guidance when needed.

- ASIC-regulated platform with CHESS-sponsored holdings.

Customer Service at Stockspot

Stockspot offers 24/7 multilingual support via live chat, email, and a ticket system. Its Help Center provides guides and FAQs for quick self-service, while urgent issues like KYC, withdrawals, or security are prioritized. The platform also engages users through Telegram, social channels, and its blog for updates and community support.

Subscribe For the latest updates every week

Get a deep insight about top reviews from top platforms spanning 50+ platforms and new financial updates right into your inbox

Unbiased Reviews

Personalized Recommendations

Support

Expert Analysis