Investment Platform Reviews

Review our top platforms with 100% reliable data

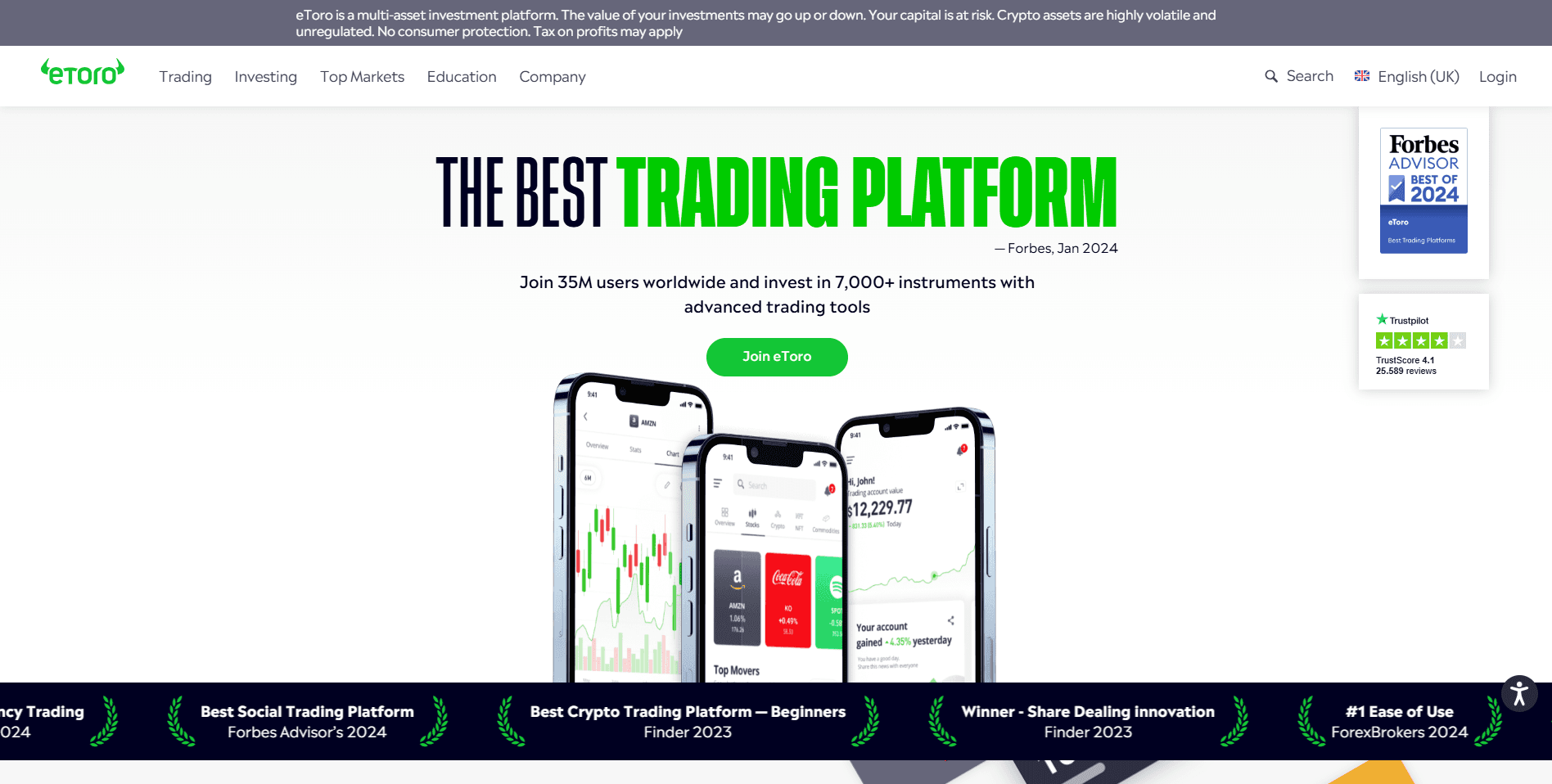

Etoro Review

eToro stands out as a highly intuitive platform that simplifies online trading for users of all experience levels. Its social trading features, particularly the ability to copy successful traders, have been invaluable in helping me make informed decisions. The platform’s user-friendly interface and seamless navigation make it easy to explore diverse asset classes, including stocks, cryptocurrencies, and ETFs. The combination of accessibility and innovation makes eToro a reliable and modern choice for traders.

With its user-friendly platform and competitive exchange rates, EToro has established itself as a trusted name in the money transfer sector.

About Etoro

eToro is a leading trading platform renowned for its low-cost access to stocks, CFDs, forex, and cryptocurrencies. It stands out with its user-friendly mobile app, commission-free stock and ETF trading, and one of the most extensive crypto offerings in the industry. A key feature is its innovative copy trading functionality, which allows users to replicate the trades and portfolios of experienced investors. While the platform excels in accessibility and ease of use, particularly for beginners, it has some limitations, including higher non-trading fees (such as withdrawals and currency conversions), limited account plan flexibility, and occasional challenges with customer service responsiveness.

Pros & Cons

User-Friendly

Intuitive interface suitable for all experience levels.

Currency Conversion Fees

AUD to USD trades incur conversion fees.

Diverse Assets

Supports a wide range of investment options, including stocks, ETFs, cryptocurrencies, forex, and commodities.

Inactivity Fees

An inactivity fee is applied to accounts that remain dormant for 12 months or more.

Social & Educational

Copy trading and extensive learning resources empowers users to learn and grow their trading skills.

Withdrawal Fees

eToro charges a withdrawal fee, which can be a drawback for users looking to move funds out of the platform.

Low Costs

Etoro provides commission-free stock trading, making it a cost-effective choice for equity investors.

Crypto Limitations

Cryptocurrencies can only be withdrawn to the eToro wallet, restricting flexibility for users who prefer external wallets.

Key Features

Diverse Asset Offerings

EToro provides access to a wide range of financial instruments including stocks ETFs cryptocurrencies forex and commodities. This diversity enables users to build diversified portfolios tailored to their investment goals.

Social Trading & Copy Trading

EToro’s innovative social trading features allow users to interact with other traders share insights and even replicate the strategies of top-performing investors through Copy Trading. This feature is particularly beneficial for beginners looking to learn from experienced traders.

Regulation & Compliance

EToro is regulated by the UK’s Financial Conduct Authority (FCA) which means the company must adhere to stringent rules and regulations designed to protect consumers.

Data Encryption

EToro is registered with the ICO (Information Commissioner’s Office) the UK’s independent authority set up to uphold information rights in the public interest and uses SSL technology to keep your information safe.

Fraud Prevention

EToro includes identity verification during registration and complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to ensure that only legitimate transactions are processed through their platform.

Segregation of Client Funds

In compliance with legal requirements eToro keeps client funds separate from its operational funds. This segregation ensures that user investments are protected and insulated from any potential financial challenges the company may face.

eToro Club & Loyalty Program

The eToro Club is an ongoing loyalty programme for our valued clients offering a wide range of services and tools to enhance their trading experience.

eToro club bronze level benefits

At this level users can access the platform’s basic features such as trading in various assets and using the social trading feature to follow and copy other traders on the platform.

eToro club silver level benefits

You will also receive access to an account manager who will be on hand to resolve any issues you may encounter.

Here are the key benefits of the eToro club silver tier

- Account manager

- Access to partner apps

- Data-driven smart portfolios

- eToro money Visa debit card

eToro club gold level benefits

Gold tier members also have access to weekly market analysis.

Here are the key benefits of the eToro club gold tier

- Weekly market analysis from professionals

- 10% discount on third part tax reporting software

- Daily market summary

- Delta PRO Investment Tracker

Range of Offerings

eToro provides a much wider range of offerings on international versions of the experience. The U.S. platform has very limited offerings compared to competitors. There are no mutual funds futures contracts or forex on eToro's U.S. platform and all trading is limited to long positions only—there is no short selling.

On eToro U.S. you have access to

- 3 cryptocurrencies

- 3,250+ stocks

- 270+ ETFs

- Crypto copy trading through CopyTrader

- Options trading

- Cash management through eToro Money9

- Portfolio automation through Smart Portfolios

- Fractional share investing

Customer Service at Etoro

The available channels for customer support present a somewhat limited approach when compared to their competitors.

TransferGo’s support is accessible through the phone but is restricted only to weekdays from 7 AM to 6 PM. This may be a significant inconvenience if you work outside these hours or on weekends.

Outside these working hours, the only available assistance is through a support form located on their website. While this may be adequate for basic operations, it’s hardly enough, particularly when wanting to transfer large sums of money.

When I called TransferGo during their working hours, I received prompt responses. The agents were well-informed and helpful, a commendable feature, no doubt. But the absence of live chat or 24/7 support is noticeably below the standard most of its competitors set.

TransferGo does not offer a dedicated account manager. This aspect might be more overlooked for those transferring small amounts, but this can be a concerning oversight for those looking to move large sums.

Subscribe For the latest updates every week

Get a deep insight about top reviews from top platforms spanning 50+ platforms and new financial updates right into your inbox

Unbiased Reviews

Personalized Recommendations

Support

Expert Analysis